how to file 1099 electronically

Electronic filing is required if 250 or more forms are filed. Filing Information Returns Electronically FIRE FIRE is dedicated exclusively to the electronic filing of Forms 1042-S 1098 1099 5498 8027 and W-2G.

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service

Fill out the 1099.

. Forms Filling Editing E-Sign Export to PDF Word E-File Online Fax. To get approval to use FIRE youll need to file IRS Form 4419. Beginning with Tax Year 2020 The Division of Taxation is requiring mandatory electronic filing for W-2s and 1099s.

No Software to Install. Produce required W-2 and 1099 files for the IRSSSA. There are three steps you need to take to send 1099 electronically to the IRS.

Ad Print Mail E-File 1099 Forms. However you must have software. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

Use Easysoft Legal Software HUD settlement statement. Ad E-File IRS 1099-MISC More Fillable Forms Register and Subscribe Now. Create state W-2 files for all states that require electronic filing.

Ad 1099 Electronic Filing Service for Printing Mailing E-Filing Corrections. Create files in the programs directory. Join Now for Instant Benefits.

Ad Free Federal And Low Cost State Tax Filing For Everyone. Filing Your 1099 Form Is Fast And Simple With TurboTax. You need to file Form 4419 Application for Filing Information Returns.

Dont file a correct 1099 by the due date 2. The simplest way to report this form is by beginning the tax interview when you sign into your eFile account. Electronic Filing Mandate for All W-2s and 1099s.

Select Upload Extension File and follow the prompts. Ad Print Mail E-File 1099 Forms. Submitting a 1099 to the IRS online via the Filing Information Returns Electronically FIRE system is the easiest and fastest route.

Each Form 1099 comes with 5 copies so make sure to write or type on. Save Time Editing Signing Filling PDF Documents Online. You can get Adob.

You can get the form here. Verify view and print files. Log in to the FIRE System.

No Software to Install. Form 1099 NEC electronic filing is quick simple and secure. File on paper if required to file electronically 3.

Ad Prepare File Deliver 1099 Forms Any Time from Anywhere. Go to the Main Menu and select Extension of Time Request. SobelCo will once again be e 1.

This will walk you through all the kinds. See How Easy It Is Today. How to Send 1099 Electronically to the IRS.

Penalties for not filing a correct 1099 wit the IRS may apply if you. You can file electronically through the Filing Information Returns Electronically System FIRE System. Electronic Filing Dont bother with the inconvenience of printing a 1099-S and then mailing it off not knowing if it will arrive or not.

Obtain a blank 1099 form which is printed on special paper from the IRS or an office supply store. Key Points for ALEs Preparing to Report Many ALEs are familiar with the IRS Filing Information Returns Electronically FIRE system. To submit the electronic file.

Federal State Filing Deadline. Ad Free Fillable 1099-MISC Form for Any Independent Contractors to E-File Tax Form Instanlty. Ad Professional Document Creator and Editor.

Just follow the steps below to complete and efile your 1099-NEC in just a few minutes.

How To Electronically File Irs Form 1099 Misc Youtube

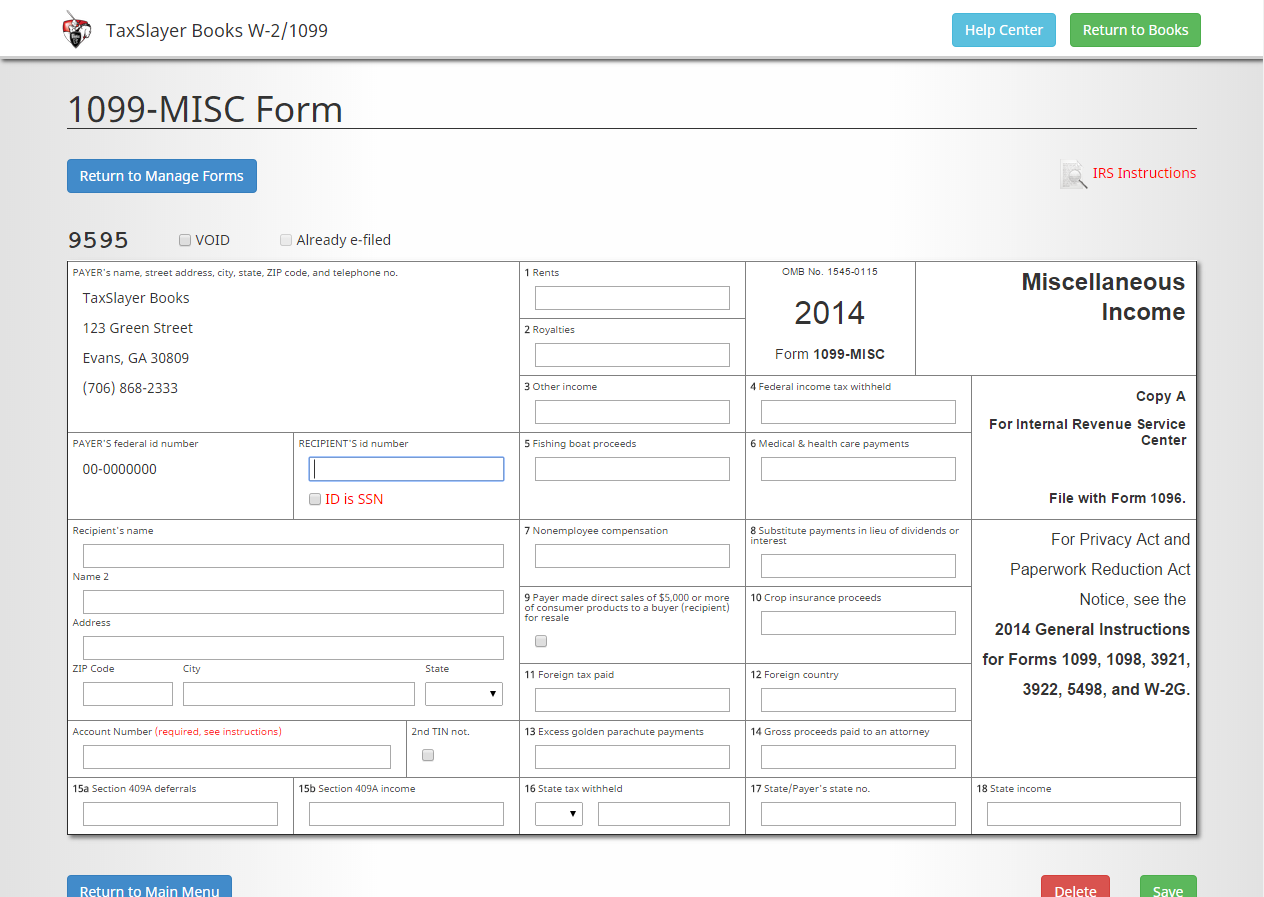

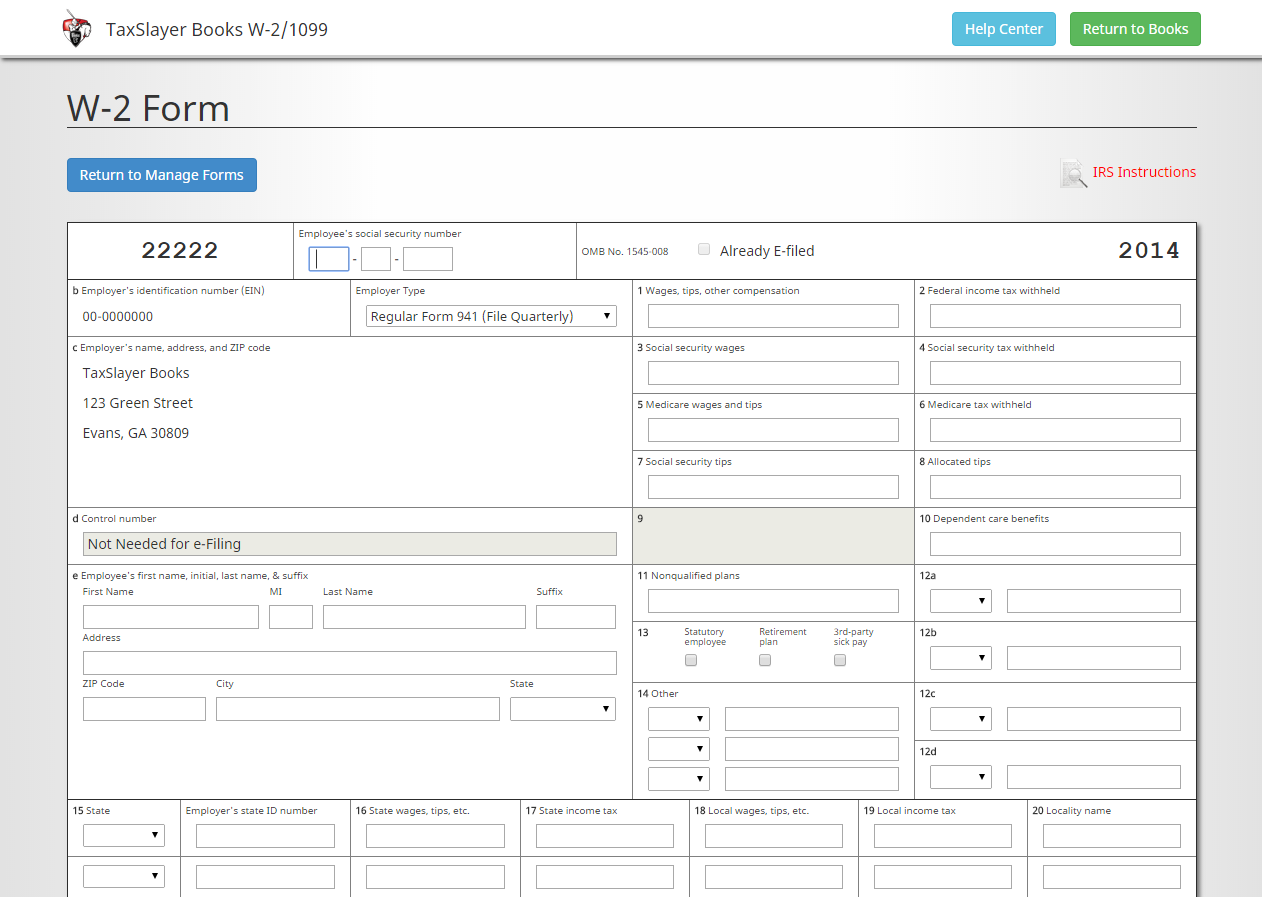

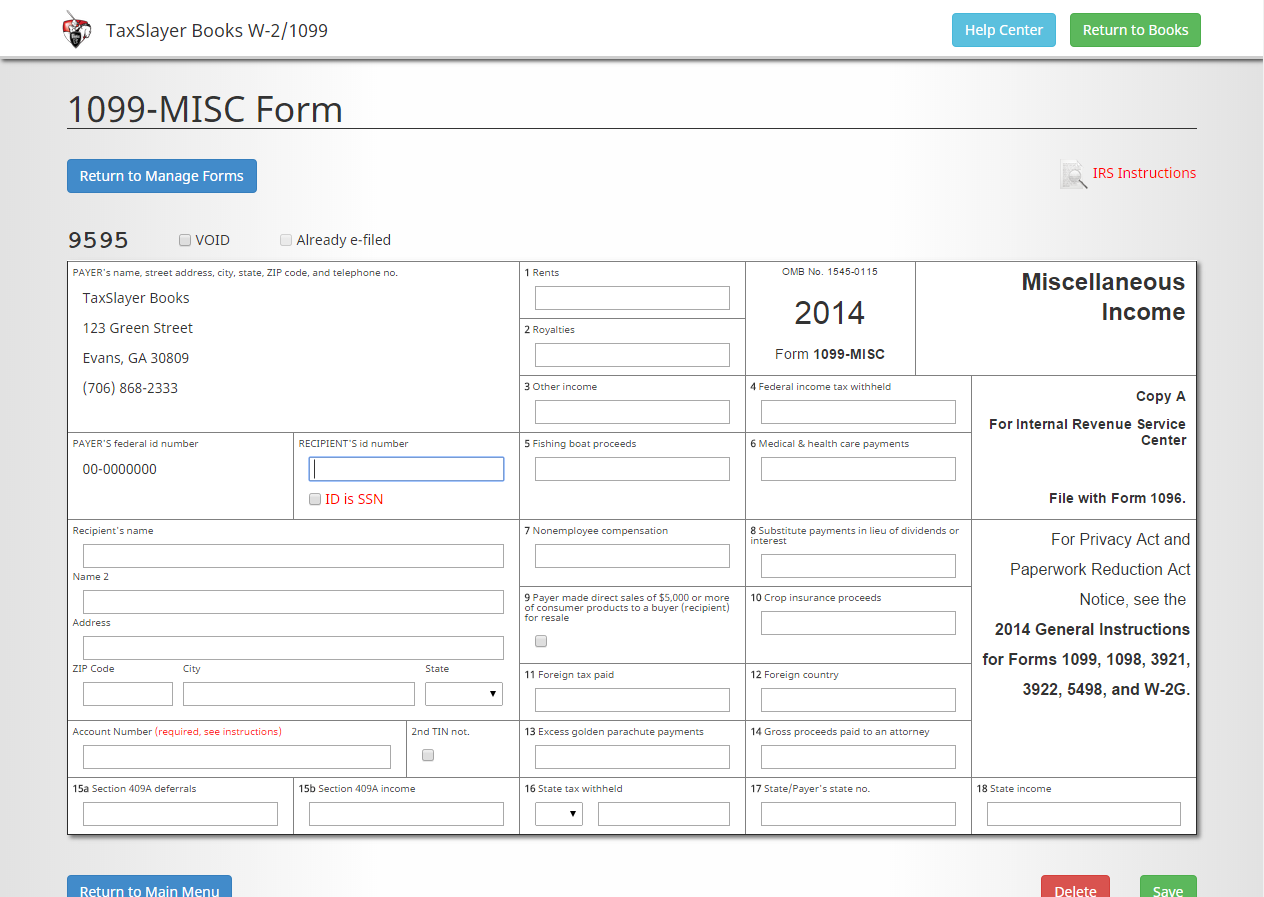

File W2 1099 Online Print And E File W 2 Taxslayer Books

How To File Form 1099 Nec Electronically Youtube

File W2 1099 Online Print And E File W 2 Taxslayer Books

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

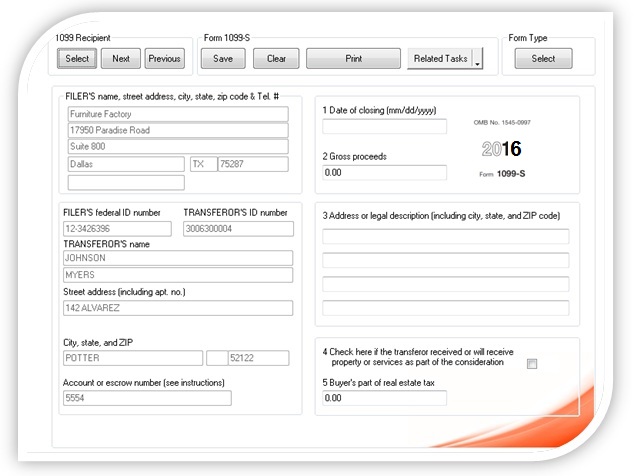

1099 S Software To Create Print E File Irs Form 1099 S

1099 S Software 2019 2020 1099 S Printing 1099 S Electronic Filing 1099 S Form Software

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

0 Response to "how to file 1099 electronically"

Post a Comment